The Dark Cloud is Coming… or is it?

We all want to know – Is there a recession coming or isn’t there? The truth is we won’t know until after it happens. The important part is to be prepared if and when it comes. The truth of the matter is, recessions are a regular thing in a healthy economy. Yeah, recessions aren’t by any means “fun” but if you know how to navigate them, recessions can be a chance for you to set yourself up financially.

Most economists do believe a recession is coming and will be here in a few months. That means you have some time to prepare. The question is, how? Are you going to run to the stock market? High yield saving accounts? Short term Treasury bonds? There’s a lot of options. But, have you ever thought about real estate investing? The truth is, the smart real estate investors look at recessions as opportunity.

Retail Money Market Funds: Low risk, liquid, short term investments

According to the Wall Street Journal, retail money-market funds in the US reached an all-time high in March, with $196 billion added to these funds between January 1st and March 29th, the largest increase since 2007. Investors are avoiding unpredictable options like the stock market and prefer a risk-free 4% return until interest rates change or until they feel confident to invest in riskier assets. However, there is no one-size-fits-all signal for when it’s time to return to a risk-on approach. Each investor’s decision depends on external economic factors and individual criteria, such as risk tolerance, financial goals, and investing expertise. Waiting too long or timing the market may result in missed profitable investments that can provide a premium over the risk-free rate.

To fight inflation, the Fed has been raising interest rates, meaning there is a possibility that you can make a bigger return on your investment in the short term using Treasuries. So, they might seem more attractive now. But, to fight inflation and really get a good rate of return, you must diversify your portfolio with these different types of treasuries. Can you name all the types of treasuries, what they do, their length of maturity? It’s giving me flashbacks of college economics class. Not many of you have the time to do the research, keep up to date with the current market, and make sure you’re getting a solid return for all the work you’re putting in. Can we all agree on that?

The Benefits of Adding Real Estate to your Portfolio

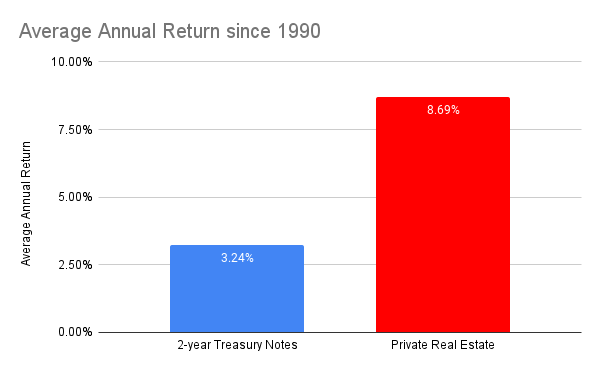

Source: NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE), U.S. Department of the Treasury

The chart above showcases the difference in the average annual return since 1990. Since 1990 there have been 4 different recessions of varying lengths. As you can see over the past 33 years, investing in real estate produced a greater return than 2-year Treasury Notes.

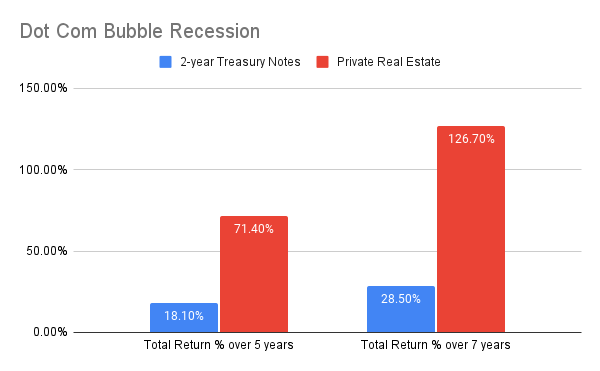

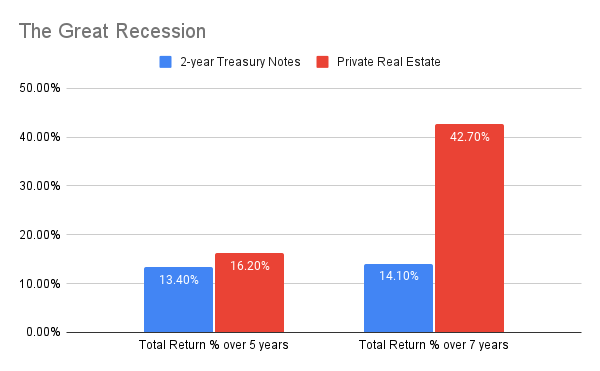

Source: NCREIF Fund Index – Open End Diversified Core Equity (NFI-ODCE), U.S. Department of the Treasury

The two charts above displays the total return percentage during specific recessions comparing 2-year Treasury Notes and Private Real Estate.

As you can see in these graphs the average and total returns from Private Real Estate outperforms 2 year Treasuries during previous recessions. Also take note of the huge jumps in returns from just holding onto private real estate for 2 more years. Private real estate and the focus of our fund is “playing the long game”. We’re not in this business for instant returns or “quick cash”. The goal is to build a legacy and secure the financial future of your family for generations to come.

What these graphs don’t show are the other great benefits of investing in real estate like tax benefits that Treasuries do not offer, plus, in our case, we do all the hard work for you. You just sit back, relax and enjoy watching your net worth grow safely.

Are you a Playmaker or a Bench Warmer?

On a recent podcast I heard a great story that relates to this concept. During COVID it seemed like the world stopped. No one was leaving their houses, large purchases were put on hold, all pencils were down. An investment company during that time did the complete opposite. They sent their acquisitions team out on private jets, flew around the country and bought deal after deal after deal. 3 years later, these deals are some of the best performing deals in the history of their company. Do you want to be the person among the rest that did nothing because you were scared and uninformed? Or do you want to be the person making a difference and building your legacy while everyone on the sidelines watches in fear? This doesn’t mean that you should blindly invest. Look for a team with a deep bench that is well capitalized and has a track record of weathering recessions. (Source: Elevate with Tyler Chesser Podcast E294 with John Chang – Commercial Real Estate Market Trends and Outlook for the Next Five Years – What Serious Investors Should Know, April 11, 2023)

Our team has done $1 billion worth of multifamily real estate transactions, with 100% of them being profitable over 15 years across multiple economic cycles. Through Apta Properties’ 18-year track record, you will be able to find expert guidance and profitable investment opportunities in real estate. From these stable assets, Apta investors are able to secure financial growth for their investment portfolios. If you want to learn more about how to get started, you know where to find us.