Recently, I had a conversation with a few friends, all of whom were firm believers in the safety of stock market index funds over real estate. Their reasoning? “The stock market delivers an average annual return of around 10%, right?” It’s an accurate statement. But what’s often missing from this conversation is a crucial concept: volatility.

If you want to truly understand the risk involved in different types of investments, you can’t just look at average returns. You have to factor in how wild the ride to those returns can be—and that’s where the concept of standard deviation comes in. Don’t worry if that sounds like a complicated math term. I’m here to break it down and show you why real estate done in a disciplined methodical fashion can actually be a stabilizer to complement your stock market portfolio.

What is Volatility?

Volatility is simply the measure of how much an investment’s returns fluctuate over time. Take the stock market, for example: while its average return might be 10%, it doesn’t grow in a straight line. In some years, it may soar by 20%, and in others, it might plummet by 20%. These swings create uncertainty, especially if you’re nearing retirement or counting on steady growth. This unpredictability can lead to emotional distress, impacting your quality of life and even your ability to sleep soundly at night.

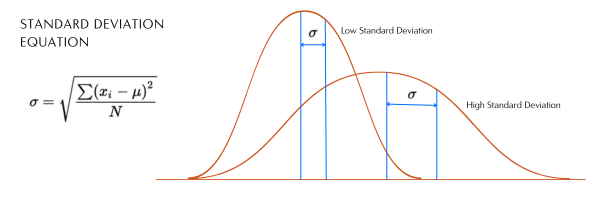

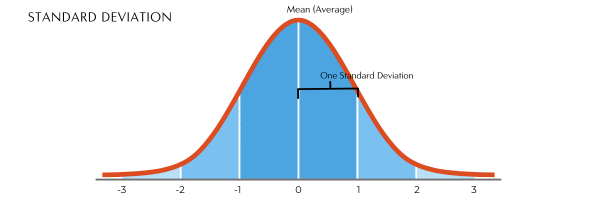

Now, how do we measure this volatility? That’s where standard deviation comes in. Standard deviation is a statistical tool that tells us how spread out the returns are from the average. In plain terms, a high standard deviation means more volatility, returns can be all over the place. While a low standard deviation indicates more stability and predictability. For context, 68% of the time, returns fall within one standard deviation of the mean, and 95% of the time, they fall within two standard deviations. This gives us a clearer picture of the typical range of fluctuations, helping investors better understand the level of risk involved.

8Standard Deviation and Investments

Analyzing standard deviations helps show which investments have long-term stability.

Below are two example investments:

Investment 1: Average Rate of Return: 10%, Standard Deviation: 5%

Investment 2: Average Rate of Return: 10%, Standard Deviation: 12%

Both investments have the same average rate of return, though with different standard deviations. Investment 2 has a higher standard deviation, which can potentially mean within one standard deviation or 68% of the time that you could earn up to 22% this year but lose 2% next year. That indicates and reflects the investment’s much higher volatility. Even though the average returns are the same, there is still a higher chance of dramatic swings in your investment.

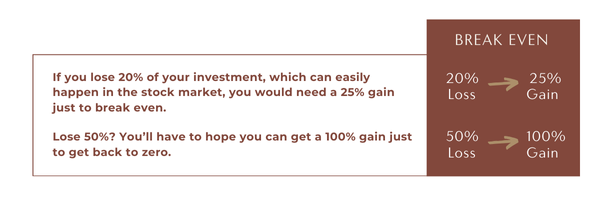

This volatility can be painful. As the saying goes, “Losses hurt more than gains help.” If your portfolio loses 20%, it requires a 25% gain just to break even. High volatility can slow your wealth-building efforts, especially if you’re relying on compounding gains over time.

While it’s true that, if you zoom out over enough years, the stock market historically returns around 10%, this volatility matters because there are decades (like 2000 to 2010) where the stock market essentially had zero return. These prolonged periods of stagnation can significantly impact your financial goals and the timeline for achieving them.

Why Real Estate is a Stable Investment

Now, let’s compare this to real estate, particularly private real estate investments like the ones we focus on at Apta Investment Group. Our historical returns are higher, around 17%, but here’s the real game-changer: the volatility is much lower.

Consider this with our real estate investments, the returns have typically ranged from 9% to 25%. This results in a low standard deviation showcasing how tightly returns cluster around the average. What does this mean for you? Even when the market underperforms, our real estate investments generally stay well above the zero line, avoiding negative returns.

To put it in perspective, actually experiencing a loss period in our model, let alone a “significant” loss would require the market to move beyond two standard deviations, a statistically rare event. This reduced volatility makes real estate an asset class with predictable and stable returns over time, compared to traditionally more volatile investments like stocks. We encourage incorporating real estate into your portfolio to enhance diversification and stability, complementing your stock investments rather than replacing them.

Risk vs. Reward: The Sharpe Ratio

When evaluating investments, it’s important to weigh the risk against the reward. The Sharpe Ratio is a handy tool for this, as it measures how much return you’re getting relative to the risk you’re taking. Without diving too deep into the math, a higher Sharpe Ratio indicates that an investment is giving you better returns for the level of risk.

Real estate, especially private real estate, tends to offer a higher Sharpe Ratio than the stock market. Why? Because the returns are strong, but the risk (volatility) is much lower. So, you’re not only growing your wealth but doing so with less stress and fewer sleepless nights worrying about market swings.

Stability in Real Estate Investments

If the ups and downs of the stock market have you searching for a way to add stability to your financial journey, real estate investments offer a strong complementary approach. Unlike the volatility often seen with stocks, real estate can provide steady returns with a narrower range of fluctuations.

By incorporating real estate into your portfolio, you can diversify your investments, which helps to reduce overall risk while maintaining growth potential. At Apta Investment Group, we design opportunities that work alongside your existing investments, helping you pursue financial stability and independence with a more balanced approach.

How Apta Investment Group Can Help

At Apta, we specialize in guiding you through the process of diversifying beyond the stock market by integrating multifamily properties, retail spaces, and medical offices into your portfolio.

This strategy offers a path to both stability and growth through real estate, helping to balance the swings of stock market investments while aiming to achieve your long-term financial goals.

With a 100% profitability record on over $1 billion in transactions, Apta and our partners have structured investments that align with your needs, allowing you to focus on what matters most whether that’s your career, family, or personal passions.

Let’s explore how a balanced investment strategy, can be the foundation for the financial future you deserve.

Schedule an introductory call today.

Sources:

- “S&P 500 Average Return and Historical Performance,” Investopedia, 2024.

- “Standard Deviation Formula and Uses vs. Variance,” Investopedia, 2024

- “Average Stock Market Return,” Forbes, 2023.

- “The Power of the Sharpe Ratio in Real Estate,” Investopedia, 2022.