FUND I IS FULLY SUBSCRIBED

Be the first to know when fund II is available

Review Past Funds | 37P Fund I Overview

- Fund Name: Apta – 37P Fund I LLC

- Sponsors: Apta Investment Group and 37th Parallel Properties

- Asset Class: Value-Add and Core-Plus Multifamily

- Deal Sizing: $25M-$80M

- Fund Size: $20M-$40M

- Annualized Return Targets: 8% Preferred Return | Total Annualized Return Estimate 12%-15%

- Fund Term: 8-10 years, including capital gain deferral opportunities

- Minimum Investments: $100,000

- Average Investment: $230,000

- Objective: The objective of the Fund is to acquire, value optimize, and sell multiple multifamily real estate investments acquired in key markets across the U.S. that have the potential for attractive, risk-adjusted returns.

- Current Holdings:

- Haven North East | Atlanta, GA (acquired July 2021)

- Heights of Cityview | Fort Worth, TX (acquired February 2022)

- Creekside South | Wylie, TX (acquired July 2022)

- Grand Reserve | Katy, TX (acquired December 2022)

- Greys Harbor at Lake Norman | Huntersville, NC (acquired October 2023)

Current holdings

-

Haven North East Atlanta, GA | 240 units | Acquired July 2021

Haven North East is the premier community located northeast of Atlanta with close proximity to Chamblee, Norcross, and more. By choosing Haven North East, you are within minutes of Interstates 285 and 85 N, allowing a short commute to Buckhead, Brookhaven, downtown, and more. Our open kitchen concept designed for entertaining and our breathtaking landscaped scenery offer a relaxing and beautiful place to call your new home. You can find solace in our one-, two-, and three-bedroom floor plans.

-

Heights of Cityview Fort Worth, TX | 344 units | Acquired February 2022

The Heights of Cityview offers a variety of spacious one-, two-, and three-bedroom layouts with open kitchens, stainless steel appliances, walk-in closets, and private patio/balcony space. The property features a Wi-Fi cafe, gym, garden, putting green, and resort-style pool. The community offers easy access to downtown Fort Worth and Clear Fork Trinity River. Also, The Stockyards, Hulen Mall, and Seventh Street are only a few miles away, and downtown Fort Worth is a quick commute.

-

Creekside South Wylie, TX | 252 units | Acquired July 2022

Creekside South is a community located in Collin County, in beautiful Wylie, Texas. The garden-style apartments offer one-, two-, and three-bedroom options with a variety of in-home and community benefits. In-home features include designer custom cabinetry, and open concept kitchens with granite countertops and stainless steel appliances. Enjoy the convenience of the suburban lifestyle close to City Park, with everything you need at your fingertips.

-

Grand Reserve Katy, TX | 291 units | Acquired December 2022

Grand Reserve, developed in 2013, has been professionally owned and maintained since completion. The three-story garden-style property has 9-foot ceilings and features an impressive 141 attached garages, an additional 69 detached garages, upscale amenities, green space, a resort-style pool, and outdoor lounge area. The property is located in the highly sought-after Houston suburb of Katy, Texas, where all key demographic trends support sustained housing demand, income growth, and rent growth. It is situated near the highly visible intersection of the Westpark Tollway and Grand Parkway, where more than 35,000 vehicles travel per day.

-

Greys Harbor at Lake Norman Huntersville, NC | 312 units | Acquired October 2023

Greys Harbor at Lake Norman, developed in 1997, has been institutionally owned and maintained since completion. The three-story garden-style property has 9-foot ceilings and features upscale amenities, detached garages and storage, a resort-style pool and outdoor lounge area. The property is located in the Lake Norman/Huntersville submarket of Charlotte, NC, which has experienced significant growth in recent years due to its strong economy, great schools, and attractive lifestyle.

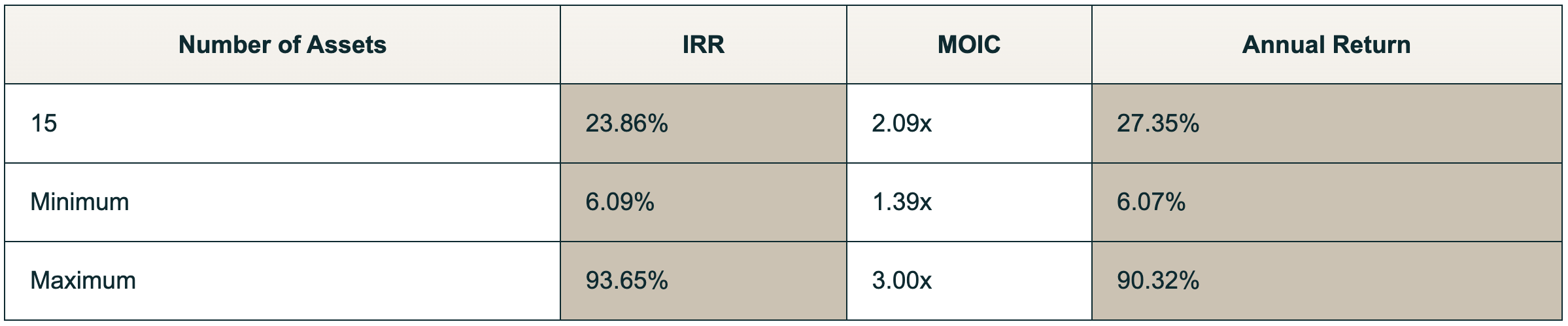

Performance summary

With the goal of acquiring, value optimizing, and selling multifamily properties, in key markets in the United States, the Apta team and partners have acquired and sold 15 multifamily properties averaging a 27.35% annual return and crossing over $1 billion in acquisitions.

Why invest with APTA?

Apta’s world-class investment team leverages the experience and business acumen of a successful surgeon and proven entrepreneur who has an 18-year track record of profitable real estate investments and has invested seven figures alongside you in the Fund. We take a demographic-driven, systems-based approach to market selection and acquisitions — a strategy that has generated a 100% profitable investment track record since 2008. Our team helps screen, select, and manage assets for you – the same assets that we invest in ourselves.

Investment criteria

- Population and employment/income growth > U.S. average, positive net domestic migration

- Employment diversification across multiple industries

- Environmental stability and predictability

- Landlord and business-friendly states

- Target markets based on attractive demographic factors, strong tenant demand, supply constraints, and exit liquidity