In the ever-evolving world of investment, there stands an unyielding truth, time is money. The world of real estate investment, like all sectors, is rife with risks and uncertainties. But amidst these variables, two principles often emerge as guiding lights:

- Time in the market is invaluable

- And timing the market is a near-impossible feat

The True Cost of Inaction

When contemplating any investment, the fear of potential losses often outweighs the hope of gains. However, in the domain of real estate, the cost of doing nothing often translates to missed opportunities. The market will inevitably ebb and flow, but by not participating, one risks missing out on consistent appreciation, tax benefits, and potential cash flow. As the saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.”

Time in the Market vs. Timing the Market

It’s a common misconception that the key to real estate riches lies in perfectly timing the market. However, as history and statistics have shown, it’s nearly impossible to consistently predict market peaks and troughs.

Instead, the emphasis should be on ‘time in the market’. A long-term approach allows investors to benefit from compounding growth and hedges against short-term market fluctuations. By staying invested over a longer period, you will witness the power of appreciation, leverage, and rental income, which cumulatively outweighs the short-term uncertainties.

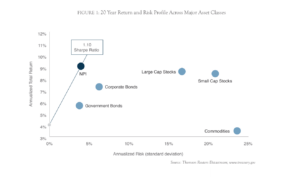

Over the last 20 years direct ownership of commercial multifamily real estate has had the best risk adjusted returns over any other asset class, the stock market, bonds, and REITs. In fact those returns were 3 to 4 times less risky than REITs as well as large and small cap stocks. In this diagram below, NPI measures all commercial real estate (CRE) classes. Multifamily has the least amount of risk among all CRE classes.

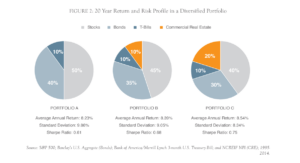

Here is what could happen to people’s portfolios when they diversify into commercial real estate. By selling off 5% of their stocks and 5% of their bonds and investing that 10% in direct ownership of real estate, they realize better returns with less risk. Increasing that allocation to 20% in direct real estate further increases returns while decreasing risk. In that way, diversification into direct real estate has a stabilizing effect on stock/ bond portfolios by enhancing returns while decreasing risk.

Real Estate Is A Get Rich Slowly Game

Real estate is often marketed as a quick path to riches. While it’s true that some have made swift fortunes, quicker paths to large cash injections in real estate come through doing deals that require a lot of time and attention. It is really a full time job and for those who love to deal directly with tenants, repairs, complete total rebabs and construction. This path to riches is not for everyone.

For most, particularly professionals seeking to passively invest, it’s a long game. It’s about building equity, leveraging tax advantages, and earning consistent rental income. The value of real estate tends to grow steadily over time, and with patience, the returns can be substantial.

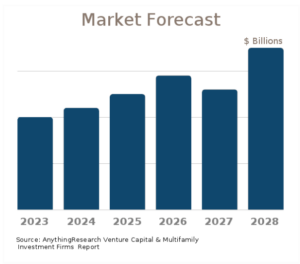

Real Estate is a growing market despite turbulent economic times. The global real estate market was valued at $28,917.7 billion in 2021 and is projected to reach $48,923.3 billion in 2031. Allied Market Research shows us how COVID-19 led to a slowdown in the progress of construction projects along with sales of real estate properties in 2020. However, the industry recovered in the years 2021 and 2022.

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year / six-year demand forecast projects both short-term and long-term trends.

The Importance of Reliable Sponsors

In the realm of real estate investments, particularly syndications or partnerships, the quality of sponsors cannot be overstated. Investing with sponsors who possess financial capacity and have weathered previous recessions can provide an added layer of security. Their experience, knowledge, and resilience in navigating downturns can prove invaluable, ensuring that your investment is not only secure but also thriving.

When it comes to your hard earned money, you do not want to place it in the hands of someone who is on the job training. Looking for a group that has a track record of success, does proper due diligence, and has maintained profitability to investors even during difficult economic times is a must.

Many of today’s best-known companies were founded during the Great Recession in 2009, Business Insider shows us 14 successful companies that started during a US recession including Uber and Airbnb. Bill Gates founded Microsoft in 1975, the same year as the oil embargo recession.

Having lived through recessions, valuable lessons include: maintaining low leverage and liquidity. At Apta, our deals typically have 50-60% leverage vs. most real estate deals that are between 75-85% leveraged. A lot of sponsors don’t maintain enough liquidity and don’t have the financial muscle to withstand a recession. But for those that do, they come out of recessions ahead.

Our entire team survived during the 2008-2009 recession, the European Debt Crisis and the pandemic. During those times we have done over $1 billion in transactions and because of our experience and preparedness we always made money for ourselves and our investors with zero losses.

To learn more about working with our team, start your journey here.

The Napkin Test… Simplifying Investment Logic

Warren Buffet says you should be greedy when others are fearful and fearful when others are greedy. He says that you should only invest in things that can be explained on the back of a napkin….what’s easier than explaining a bedroom, bathroom, and kitchen?

A golden rule for any investor… If an investment can’t be explained on the back of a napkin, think twice. Complex investment strategies or structures can often mask underlying risks or fees. In contrast, the core principles of real estate—investing in real property and benefiting from appreciation, leverage, and rental income—are straightforward and have stood the test of time.

Andrew Carnegie famously said that 90% of millionaires invest in real estate. CNBC wanted to see if this still held true today. It is a resounding yes. Other asset classes have wins and losses, ups and downs, but Real Estate has remained the most tried and true, consistent, and appreciating asset class of all time.

In the same article CNBC asked some of the most recognizable real estate figures or dare we say, moguls how real estate has impacted their financial status. Here are a few quotes:

“Owning Made Me Rich” —Barbara Corcoran, founder of The Corcoran Group, podcast host of “Business Unusual,” judge on “Shark Tank”

“Investing in real estate is a great idea if you are in it for the long haul, not a quick return”

—Bethenny Frankel, entrepreneur, philanthropist, founder of Skinnygirl and BStrong. Follow her on Instagram

Over time, you will always get value from real estate that produces income — like a coffee farm, for example. Even better if you choose property with inherent value, such as a location in Times Square.”

—Marcello Arrambide, founder of Day Trading Academy, co-founder of SpeedUpTrader, a funding company for aspiring day traders. Follow him on LinkedIn

The real estate market, like life itself, waits for no one. While there are always risks associated with investments, the cost of inaction can be far greater. Investing in real estate now, with a long-term perspective, guided by experienced sponsors and rooted in fundamental principles, can pave the way to a prosperous financial future. The journey to wealth in real estate may be slow, but it is steady and rewarding.

For more information on how to invest today, start creating passive income, and building wealth to leave behind for generations to come, contact us for a complimentary wealth strategy call.

We will assess your personal goals and help to guide you into the highest quality real estate investments to help you get there.