In times of profound change, where the fabric of our financial world seems to unravel at the seams, the words of Vladimir Lenin ring eerily true: “There are decades where nothing happens and weeks where decades happen.” Today, as we stand amidst swirling currents of inflation, sovereign debt crises, and geopolitical shifts, it’s easy to feel adrift in a sea of uncertainty. Yet, it is precisely within this tumult that the keen-eyed investor can spot the lighthouse of opportunity.

The global landscape is undeniably transforming, and with it, the principles of investment. Amidst the cacophony of headlines and the dramatic flair of media narratives, discerning the true nature of economic and geopolitical developments requires a perspective that’s both educated and objective. This is no small feat in an environment where sensationalism often overshadows substance. But history, with its cyclical tales of boom and bust, teaches us a valuable lesson: economic downturns, while challenging, can also pave the way for unparalleled investment opportunities.

Consider the legendary Joe Kennedy, father of JFK and RFK, who, through strategic foresight and a refusal to succumb to fear, grew his wealth from $4 million to $160 million during the Great Depression in just six years… ($3 billion in today’s dollars). Such stories underscore a powerful truth: with strategic thinking and a willingness to look beyond the immediate chaos, it’s possible to not just survive but thrive.

Insights from the World’s Foremost Minds

My recent participation in the Platinum Finance 2024 conference, hosted by none other than Tony Robbins, provided a unique opportunity to glean insights from the luminaries of finance, geopolitics, and investment strategy. Figures such as Ray Dalio, Howard Marks, Jeffrey Gundlach , David Golub, Mike Pompeo, and Peter Mallouk, who shared their candid perspectives, untainted by media bias, offered a masterclass in navigating the complexities of today’s economic climate.

I am grateful to have heard perspectives through personal conversations with guys like Peter Mallouk, CEO of Creative Planning, the largest fiduciary advisory firm in the country and Ajay Gupta, who runs the joint family office of him and Tony Robbins.

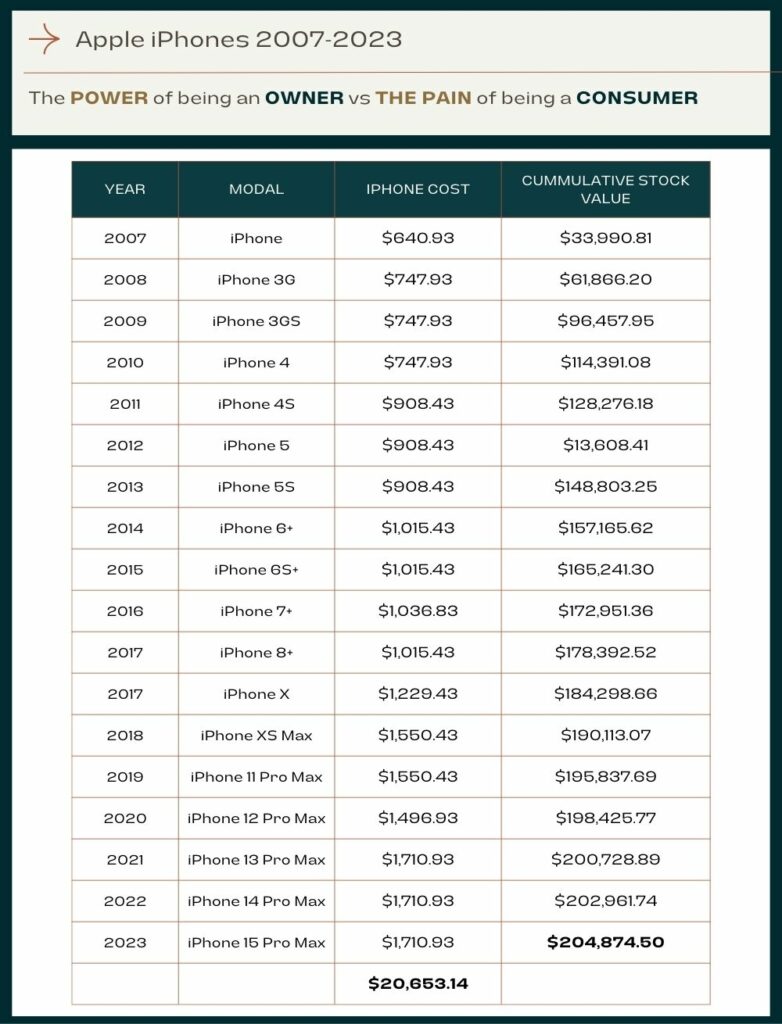

A central theme emerged from these presentations and discussions: the paramount importance of ownership. Whether through private equity, venture capital, or real estate, becoming an owner rather than a mere consumer or lender can dramatically alter the trajectory of your financial journey. To illustrate, imagine the difference between purchasing an iPhone every year since its inception versus investing that same amount in Apple stock. You could have spent $20,653 or have $204,874 in Apple stock. It’s like playing in the casinos versus owning the casinos! The disparity in outcomes is not just dramatic—it’s transformative.

Embracing Ownership with Strategic Asset Allocation

Ownership, however, comes with its own set of challenges, notably liquidity. That can be mitigated by making sure you have ample liquidity in other parts of your portfolio. More on that below. The rewards, as articulated by investment giants like Ray Dalio, lie in strategic asset allocation. Dalio advocates for diversifying across 8-10 uncorrelated assets, a strategy proven to mitigate risk by as much as 80% without sacrificing return. That is truly an amazing mathematical fact! This approach not only shields your portfolio from volatility but also positions it for sustainable growth.

Peter Mallouk offers a blueprint for allocation based on your financial timeline, suggesting a mix of liquid and illiquid investments tailored to when you’ll need access to your funds. This methodology ensures that each investment not only serves your immediate needs but also positions you to safely maximize growth of your portfolio. For example If you need the money within 5 years, you should invest as a “lender”: bonds, CD’s, short term notes etc. If you need the money in 5-10 years: invest in a low cost stock market index fund. If you don’t need that money for 10 years or more: you should invest in private investments like private equity, private real estate, private credit, and other businesses. If done appropriately, they generate more of a return than the 0-5 year and 5-10 year buckets and have less risk, and provide significant diversification as uncorrelated assets. Naturally, you would expect a greater return for illiquid investments. Fortunately, with this model, you have solved for all your liquidity needs with the other two buckets. This way you can sleep at night with no need to predict what is going to happen in the next 12 months.

A Path Forward with Apta Investment Group

At Apta Investment Group, our mission extends beyond financial education. We aim to empower our community of surgeons and others like surgeons, guiding them through the intricacies of real estate investment and beyond. Our focus is on building relationships and providing access to private investment opportunities typically reserved for the ultra-wealthy.

In the coming months, we’re excited to share more insights and strategies to help you navigate this economic winter. By embracing the principles of ownership, strategic asset allocation, and the pursuit of uncorrelated assets, we believe that not only can you safeguard your financial future but also lay the groundwork for generational wealth and stability.

In these transformative times, let’s draw inspiration from the past to illuminate our path forward. Together, we can turn uncertainty into opportunity, fear into strategy, and investments into legacies.

To learn more about our assets and track record, check out our current offerings.