The commercial real estate market, and especially multifamily, a once-booming sector, is experiencing a significant shift. Let’s explore the current landscape of multifamily deals, underpinned by a series of economic and market dynamics that have transformed the sector over the past year as well as our decisions to do only one deal during this year vs. six deals in 2022.

Decline in Multifamily Sales

Multifamily sales have seen a dramatic decline, dipping by 74% year over year. This significant drop raises questions about the underlying factors driving this downturn and its implications for investors and the market.

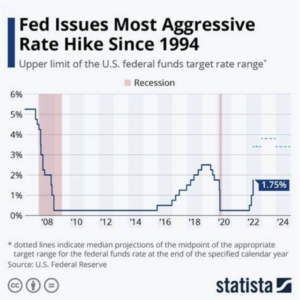

The Federal Reserve’s Response to Inflation

In an effort to combat rising inflation, the Federal Reserve has been compelled to implement a series of interest rate hikes. These actions, while necessary to stabilize the economy, have had a ripple effect across various sectors, including real estate. According to NPR, Higher borrowing costs have weighed on sensitive sectors of the economy such as housing. But consumer spending remains strong and unemployment is still low, although hiring has slowed in recent months. The Federal Reserve hints at more action this year.

Doubling of Borrowing Costs

One of the direct consequences of the Fed’s monetary policy has been the doubling of borrowing costs. This increase has made financing more expensive for investors and developers, impacting the feasibility and attractiveness of new multifamily projects.

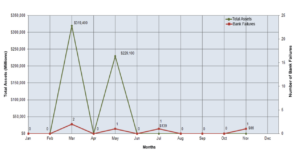

Bank Failures in 2023

Another impact during the year 2023 has been several bank failures, contributing to financial uncertainty and tighter credit conditions. These failures affect the availability of loans for real estate investments, further complicating the multifamily market landscape. According to the FDIC, in 2023, First Republic Bank, Silicon Valley Bank, and Signature Bank, as well as a few others closed. During this period PNC also closed 21 branches and opened 3, and Huntington Bank closed 17 branches and did not open any new locations.

There are 5 bank failures in 2023. See detailed descriptions below.

Increase in Multifamily Capitalization Rates

Reflecting these challenges, multifamily capitalization rates have increased by approximately 150 basis points or 1.5% over the past 12 to 18 months. This rise indicates a higher risk perception in the market, affecting investor returns and valuations.

Trillion-Dollar Debt in Multifamily Sector

Multifamily property owners are currently saddled with a staggering trillion dollars of debt, which is due for repayment within the next four years. This debt burden poses significant risks and challenges for the sector, especially in the current economic climate. Additionally, there has been a surge in new multifamily unit development. Despite these headwinds, there is a record number of new multifamily units in the pipeline. This influx could potentially lead to an oversupply in certain markets, affecting rental rates and occupancy levels.

Is there a light at the end of the tunnel?

The single-family home affordability crisis may contribute to an increase in rental needs.

Amidst these trends, the single-family home market is grappling with its affordability crisis. This situation is unlikely to resolve soon, leading more individuals and families to turn to rentals. The increased demand for rental units could offer some reprieve for the multifamily sector, balancing out some of the negative impacts discussed earlier.

There is still a large shortage of rentals available for people who need to rent. In this CBS interview, they state that would-be-home buyers are forced to rent the American Dream. In this interview Daryl Fairweather, chief economist at Redfin, a nationwide real estate brokerage firm that pulls together real-time statistics on both the sales and rental markets. For example, their numbers show that rents increased 31% in Jacksonville last year, and 40% in Austin, Texas.

Finding the right deals has never been more important

The multifamily real estate market appears to be at a crossroads, influenced by economic policies, market dynamics, and broader financial trends. We see challenges abound, from rising interest rates to a looming debt crisis, however, the enduring demand for rental housing provides hope. Investors and stakeholders in this sector must navigate these complex conditions with a strategic approach, balancing risk and opportunity in a rapidly evolving landscape. The opportunities exist but we take a careful approach to our vetting and our due diligence process.

Market data, property conditions, value-added components, assumable loans, and private financing, are all things to consider. Sometimes patience is the best option and at Apta, we look for deals that fit our model of choosing high-quality assets that have the right components to be recession-resistant. Our investor safety and stability are our highest priority and with well-performing assets currently, we will not settle for a good deal, we will wait for a great deal.

As we close this chapter of 2023, we look ahead with great optimism for the next 12-24 months

We are excited about the opportunities that will come from the struggles that the market imposed during this year. We are well positioned for the jewels on the horizon.

We are long-term holders and our assets are sound. Our existing investors will continue to make money on assets we purchased over the past few years and we won’t sell now….

When we look at vetting for 2024 and beyond, we believe there will be a lot of opportunities for demographically sound assets that will become available because of debt being due on assets that were purchased based on speculative operators and business models.

Warren Buffet once said to be fearful when others are greedy and to be greedy when others are fearful.

How we remedy the issues of 2023

We stick to the fundamentals….we study demographic trends which are long-term cycles, not short-term economic cycles. We don’t want to overpay, but believe that our conservative underwriting, and low leverage (50-60%) are sound. We either borrow with fixed-rate debt or purchase rate caps which limit the upper exposure of interest rate costs, which will create opportunities. This type of environment is when our model shines the most in comparison to other models.

A bull market makes everyone look like a genius, and a bear market forces the cream to rise to the top.

Happy holidays from our families to yours. If you would like to explore our current opportunities and be positioned well alongside us as we emerge into 2024 with stable tax-advantaged safe investments, contact our team today!

Current Investment Opportunities – Apta Investment Group